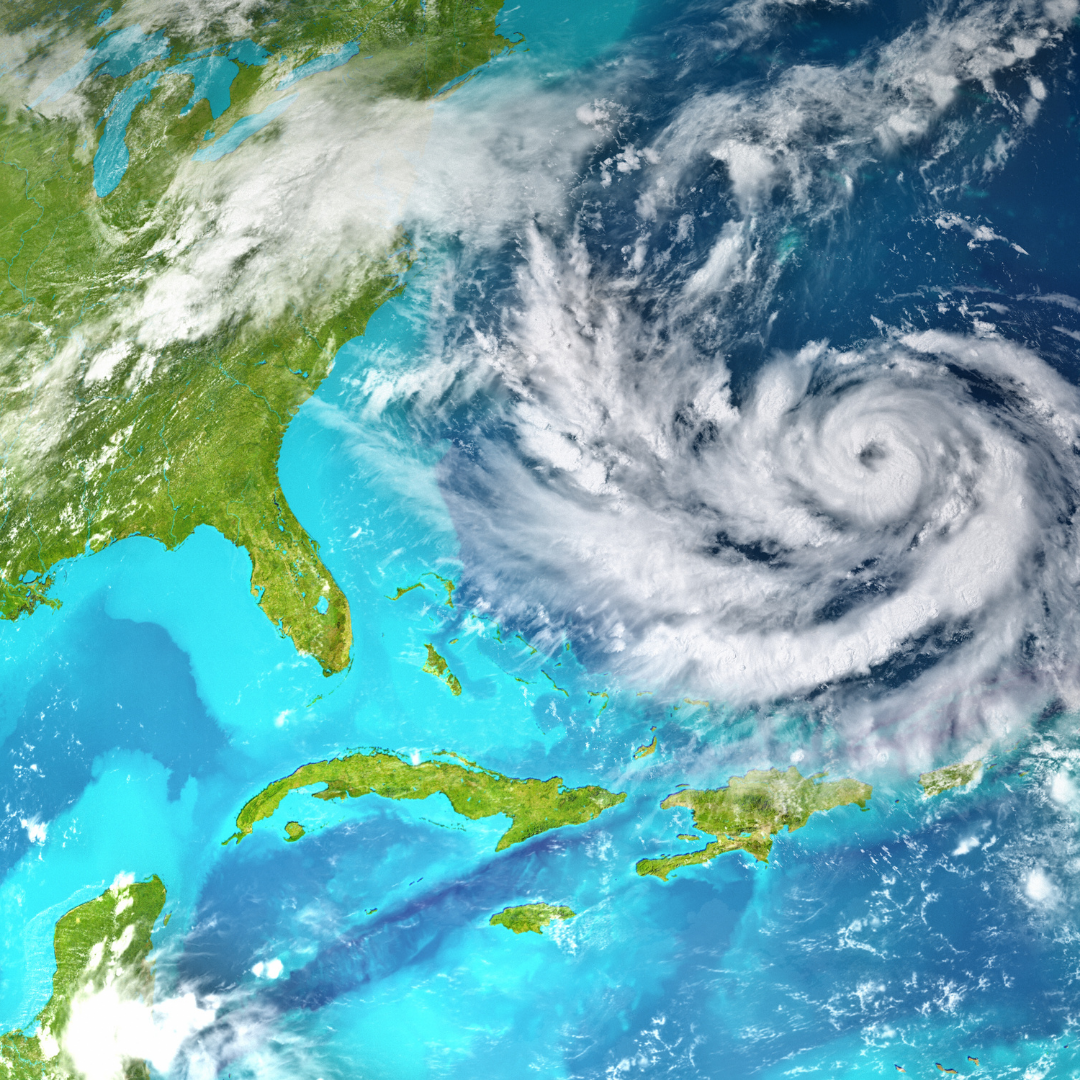

Along the Atlantic Seaboard, June through November is known as hurricane season. It’s important to remember that both coastal and inland areas face the risk of storm surge, wind damage, and flooding. While you can’t stop a storm from coming – you can be prepared.

Review your Insurance Coverage

Begin by verifying that your commercial or homeowners’ property insurance is still in effect. When you are reviewing your coverage, you should consider extending it to include windstorm damage, flooding, temporarily living expenses, valuables, and personal possessions.

Windstorms are generally considered a peril that is covered or fixed to your policy as a rider (an insurance policy provision that adds benefits to or amends the terms of a basic insurance policy). However, not all policies cover wind damage. Be sure to read your policy or speak to your agent to assure that you’re covered.

Flood Insurance is a major coverage that you want to ensure you have on your policy. Keep in mind that the standard homeowner’s policy does not cover flood damage. While your policy may cover water damage, this is not the same as flood damage. The main difference between the two is simply where the water comes from. Water damage is typically caused within the home; whether it be an overflowing bathtub, burst pipe, broken toilet, etc. Flood damage occurs when there are storms with flash floods or rising water around bodies of water. Don’t wait to get flood insurance! If you DO NOT currently have a flood insurance policy, there is a 30 day wait for a policy with the National Flood Insurance Program to be effective. Most insurers will not adjust coverage once a storm is already in effect.

Additional living expenses (ALE) covers you if you are temporarily displaced from your residence. These additional living expenses would include, rent, hotel stays, food, storage fees, and more. Most standard homeowners’ policies will cover ALE.

Finally, it’s beneficial to obtain a digital copy of your policy from your agent. And keep all important physical documents, such as medical records, insurance policies, licenses, birth and marriage certificates, bank information, home inventory, etc. in a structurally sound and secure place (preferably waterproof).

Hurricanes and tropical storms can leave families devastated and belongings destroyed. Make sure you’re prepared with the following steps:

- Prepare a Disaster Supply Kit

- Create an inventory list of possessions both inside and outside of your home through a spreadsheet, written list, time-stamped photos, or videos. Email it to yourself and your agent. This list will be needed during the claim process.

- Plan an evacuation route, including any plans for pets. Always evacuate and stay off the roads when local authorities recommend it.

- Locate local emergency shelters

- Create a map of safe routes and be aware of marked water crossing points (ie. low-lying bridges, or areas prone to tidal flooding)

- Create a communication plan with your family

- Back up and fully charge all electronics

- Review how to properly shut off all appliances and utilities

- Secure the outside of your home with storm-shutters or board access points such as doors, windows, or garage doors.

- Trim any low hanging branches that are near or hanging over your property

- Bring in any outdoor furniture, garbage cans, potted or hanging plants, garden tools etc.

- Seal outside vents, electrical outlets, wire openings, pipes, and garden hose bibs

- Park your car in a secure spot. If in the garage – park against the door

- Keep valuables away from windows and doors

A Hurricane Watch means that hurricane conditions are possible, typically within 48 hours. This is the time in which you want to secure your house and possessions, gather your supplies, and be prepared to evacuate.

A Hurricane Warning means that hurricane conditions (sustained winds of 74 mph or higher) are expected. These conditions are usually expected within 36 hours. Seek shelter and keep alert to evacuation announcements.

STAY INFORMED WITH THESE RESOURCES:

National Weather Service

Massachusetts Emergency Management Agency

Federal Emergency Management Agency

National Hurricane Center

The National Safety Council

STILL HAVE QUESTIONS?

Send them our way and we will do our best to help!

Jeff McSharry

Associate Advisor | Private Risk

Jeff McSharry is a Private Risk Associate Advisor with RogersGray. Jeff graduated from Bentley University, where he majored in History with a minor in General Business. In his previous life, Jeff owned a yoga products business called Kulae, with a client base located across the world – making for unique partnerships. You can connect with Jeff on LinkedIn or by email.