Technology has changed the landscape for budding American entrepreneurs. As the continued evolution takes place to expand and connect us in ways we hadn’t even thought of 5, 10, or 20 years ago, more and more people are starting their own businesses from the comfort of their own homes.

Technology has changed the landscape for budding American entrepreneurs. As the continued evolution takes place to expand and connect us in ways we hadn’t even thought of 5, 10, or 20 years ago, more and more people are starting their own businesses from the comfort of their own homes.

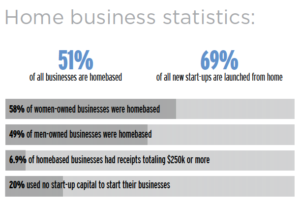

According to the U.S. Census Bureau Survey of Business Owners, 51% of all businesses are homebased and according to a GEM Entrepreneurship report, 69% of all new start-ups are launched from home.

But as some unlucky home-based business owners are finding out, a homeowner’s policy will not cover the risks of these businesses in most cases, and those who do choose to start a business at home should be thinking about business coverage.

Depending on the type of business, you’ll need insurance to protect the value of your business-related property from fire, theft, or other perils. Liability insurance also should be considered, as you would want to cover costs associated with someone getting hurt as a result of visiting your business either online or in person. If you’re selling a product, it’s also important to protect yourself in the case of customers being injured by a product your business sells.

When it comes to property, anything a homeowner has for business use is generally excluded from the homeowner’s insurance policy. Many people spend a considerable amount of money on a computer and accessories to make the business run more efficiently. If anything were to happen to these items and they were not covered, it would be a loss for the business owner.

Business coverage can also protect inventory. For example, a person who runs a home-based cosmetics business and keeps a considerable amount of stock would be devastated if there were a fire and the loss of all of those cosmetics was not covered. Damage to others’ property, insurance for valuable papers, and several other bonuses are included with business insurance.

Generally, the options for property and liability for a business based at home are:

- A special endorsement added to your homeowner’s policy

- A homebased business insurance policy

- A BOP – Business Owners Policy – which combines multiple types of coverage

Business coverage is designed to protect both property and interests, which is why it is so comprehensive. People who are providing advice or non-tangible services and products also will need a professional liability insurance policy. This will cover claims based on accusations of bad advice. Another common term for this insurance is errors and omissions coverage.

Other forms of coverage to take into consideration are auto insurance and workers’ compensation. Personal auto insurance may provide coverage for limited business use of your car. But if the business owns vehicles or if a personal vehicle is primarily used for business purposes, a business vehicle insurance policy would be needed.

Lastly, if the business has employees, business owners are also required to obtain workers’ compensation coverage. Simply hoping that a homeowner’s policy will cover a business if a claim is filed will result in frustration if the business sustains a loss. Businesses have higher risk rates than homeowners, so always count on claims being denied if they are related to a business but filed against a homeowner’s policy.

Interested in learning more about how to protect your small business or home-based business? Use the form below to contact RogersGray’s Small Business specialists with any of your questions!